FintechZoom Apple Stock

What is FintechZoom Apple Stock? The financial world is always abuzz with talk about Apple Inc. (AAPL), one of the most valuable companies globally. For investors seeking insights, platforms like FintechZoom offer valuable analysis on Apple stock performance. But what exactly is FintechZoom Apple Stock?

FintechZoom Apple Stock refers to the analysis and real-time tracking of Apple’s stock performance provided by FintechZoom. The platform offers insights into stock growth trends, future predictions, volatility, and comparisons with competitors, helping investors make informed decisions about Apple stock in the financial markets.

In this comprehensive guide, we’ll explore the current trends and forecasts of Apple stock, drawing from FintechZoom’s analysis. This article will provide detailed insights into the market performance, predictions, and key strategies for investors eyeing the tech giant.

What Is FintechZoom Apple Stock?

FintechZoom Apple Stock is a financial analytics service that focuses on the performance and trends of Apple Inc.’s shares in the stock market. This platform provides investors with comprehensive tools and insights to monitor Apple’s stock fluctuations, assess its growth potential, and understand its position relative to competitors in the technology sector. By leveraging advanced data analytics and market trends, FintechZoom offers users real-time updates, allowing them to track price changes, volume, and market capitalization.

The service also includes in-depth analysis of financial reports and forecasts, giving users a clear picture of Apple’s financial health. Through charts and metrics, investors can visualize historical performance, identify patterns, and predict future movements. Furthermore, FintechZoom Apple Stock provides news updates and expert opinions, ensuring investors are informed about factors that could influence stock performance, such as product launches or economic changes.

Overall, FintechZoom Apple Stock serves as a valuable resource for both novice and experienced investors, equipping them with the necessary information to make informed trading decisions regarding one of the most influential technology companies in the world.

You may also like: FintechZoom Pro

Introduction to Apple Stock Fintechzoom

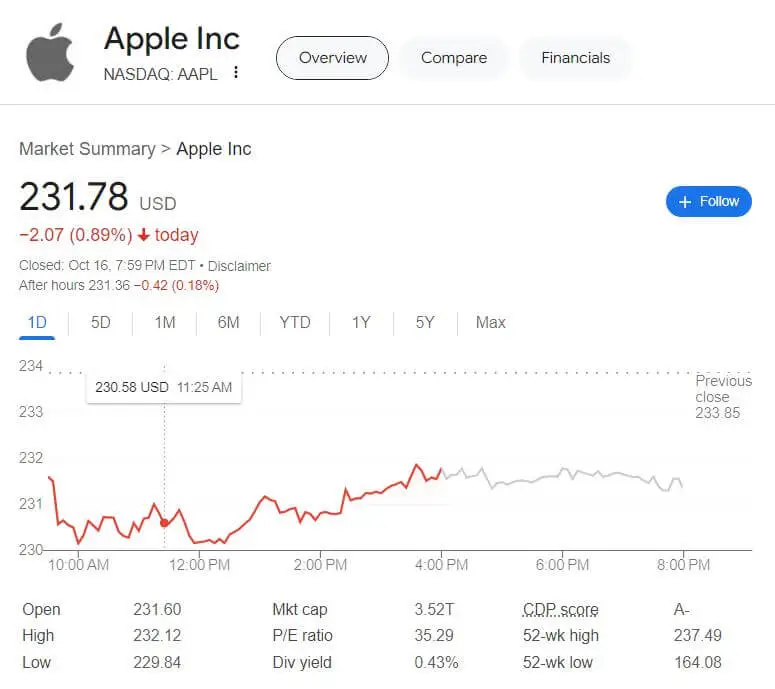

The year 2024 has been a rollercoaster for Apple stock, with FintechZoom tracking its price fluctuations in the $226-$232 range as of October 2024. The main keyword “Fintechzoom Apple Stock” is often a hot topic for market enthusiasts, reflecting the company’s ability to navigate economic challenges while keeping its innovation engine running.

Apple Stock Fintechzoom has been an essential resource for understanding the dynamics of AAPL, offering in-depth market predictions, price analysis, and tools that investors use to assess stock performance.

Key Metrics of Apple Stock Performance

Apple’s Financial Growth: Apple’s revenues are expected to surge in 2025, with projections nearing $400 billion, primarily driven by services rather than hardware sales. FintechZoom analysts highlight Apple’s strong balance sheet and strategic investments in new technology and services.

| Key Financial Metric | Value (2023) |

| Market Capitalization | Over $2 trillion |

| Revenue | $394.3 billion |

| Net Income | $94.7 billion |

| Earnings Per Share (EPS) | $5.61 |

What Does Investing in Apple Stock Fintechzoom Mean?

Investing in Apple Stock Fintechzoom means purchasing shares of a highly diversified company. Apple’s stock prices move in response to market conditions, new product launches, and quarterly earnings reports. FintechZoom helps investors track these factors in real-time, offering detailed analysis to guide investment decisions.

Key Benefits of Investing in Apple Stock:

- Strong historical growth in stock price

- Leading innovator in technology

- Stable market position with diversified revenue sources

Fintechzoom Apple Stock Price History & Forecast

Apple stock has experienced significant highs and lows. According to Fintechzoom Apple Stock Price History, the highest closing price in 2023 was $197.86, and experts predict it could reach $250 in 2024. Despite minor fluctuations, FintechZoom forecasts a bullish outlook, driven by innovation and expansion into new services.

Fintechzoom Apple Stock Price Prediction for 2024 and Beyond

FintechZoom predicts a solid future for Apple stock, with prices expected to hit $250 by the end of 2024. The driving factors behind this growth include the adoption of 5G, expansion into health technology, and the development of proprietary technologies like the M-series chips.

Factors Influencing Future Stock Price:

- 5G Expansion: Increased sales due to 5G iPhone upgrades.

- New Product Innovations: Upcoming iPhone 16 and Apple Watch models.

- Service Expansion: Growth in services like Apple Music, iCloud, and Apple TV+.

FintechZoom: A Vital Resource for Apple Investors

FintechZoom offers comprehensive tools for investors, from real-time stock quotes to detailed analysis of Apple’s financial health.

Fintechzoom Apple Stock Symbol: AAPL (NASDAQ).

Apple’s Strategy for Future Growth

1. Innovation in Product Lines: Apple continues to innovate with advanced iPhone models, better processors, and wearables like the Apple Watch. Upcoming products like the iPhone 16 and upgraded Mac computers with M4 chips are expected to boost sales in 2024-2025.

2. Expansion into New Services: Apple is rapidly growing its services sector, which includes Apple Music, iCloud, and Apple TV+. FintechZoom predicts this segment will account for a larger share of Apple’s revenue by 2025, surpassing hardware sales.

3. Health Technology: Apple’s foray into health tech through the Apple Watch has shown promise. With more health features and potential new products, this sector is a key growth area.

4. Artificial Intelligence (AI) Investments: Apple’s increasing investment in AI for Siri and iOS predictive capabilities ensures it remains competitive. FintechZoom anticipates these technologies will drive future stock growth.

Apple’s Historical Performance: Key Insights

Apple stock’s historical performance has been remarkable. FintechZoom highlights key milestones like the 2007 iPhone launch and its impact on stock prices. Under Tim Cook, Apple continued to innovate and expand, making it a favorite for long-term investors.

| Year | Notable Milestone | Stock Impact |

| 1980 | Apple’s IPO at $22 | One of the largest IPOs at the time |

| 2007 | iPhone Launch | Boost in stock price |

| 2020 | Market Capitalization reached $2 trillion | Strong investor confidence |

Economic Factors Impacting Apple Stock Fintechzoom

Apple’s stock is susceptible to several external factors, including:

- Global Economic Conditions: Inflation and supply chain disruptions impact profitability.

- Regulatory Pressures: Increased scrutiny of tech companies could pose challenges.

- Competitive Market: Rivals like Samsung and Google continue to challenge Apple’s dominance, affecting stock valuations.

Future Market Predictions for Apple Stock on FintechZoom

FintechZoom offers technical and fundamental analysis tools that are critical for predicting Apple stock’s future. These tools help investors analyze historical data and predict future stock movements using key indicators like Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

Fintechzoom Apple Stock Forecast:

- Short-Term Prediction: Mild fluctuations, with a possible peak at $250 by late 2024.

- Long-Term Outlook: Continuous growth through 2025, driven by services expansion and new product lines.

Key Risks to Consider While Investing in Apple Stock Fintechzoom

While the future looks bright, investors must keep in mind several risks that could impact Apple’s stock performance:

- Market Saturation: With smartphones nearing market saturation, growth in iPhone sales may slow.

- Supply Chain Challenges: Any disruptions in the global supply chain could affect Apple’s production capacity and stock price.

- Regulatory Environment: Increased government regulations, especially in the tech industry, could create operational challenges for Apple.

Frequently Asked Questions – FAQs on Apple Stock Fintechzoom

What is FintechZoom Apple Stock?

FintechZoom Apple stock refers to insights and analysis provided by FintechZoom on Apple Inc.’s stock performance, enabling investors to make informed decisions.

What is the current price of Apple stock on FintechZoom?

As of October 2024, Apple stock was trading around 226-$232.

What is FintechZoom Apple Stock Symbol?

The stock symbol for Apple on NASDAQ is AAPL.

What is FintechZoom Apple Stock Price Prediction for 2024?

FintechZoom predicts Apple stock could reach $250 by the end of 2024.

What are the factors influencing Apple stock price?

Product launches, earnings reports, market trends, and competition are key factors.

Does FintechZoom provide real-time stock quotes?

Yes, FintechZoom provides real-time quotes and market data for Apple stock.

What is the historical performance of Apple stock?

Apple’s stock has seen significant growth since its IPO in 1980, driven by product innovations like the iPhone and services expansion.

What are the risks involved in investing in Apple stock?

Risks include market saturation, supply chain disruptions, and regulatory challenges.

How does FintechZoom help investors?

FintechZoom offers tools for real-time tracking, technical analysis, and market insights that help investors make data-driven decisions.

What is Apple’s outlook for 2025?

FintechZoom forecasts significant growth driven by services expansion and AI investments, with revenues projected to exceed $400 billion by 2025.

Conclusion – Apple Stock Fintechzoom

FintechZoom offers investors valuable insights into the performance and future of Apple stock. With tools for technical and fundamental analysis, FintechZoom allows investors to stay informed about market trends and predictions, ensuring they can make data-driven decisions.

The forecast for Apple Stock Fintechzoom remains positive, with future growth driven by innovation, service expansion, and continued dominance in the tech industry. However, investors must stay mindful of potential risks and market dynamics to maximize their returns on investment. Hopefully, now you have got the answer to “Fintechzoom apple stock price.”